Nonprofit Ratios: How to Use Them and What They Measure for Your Organization

Written by Michelle Sanchez on May 12, 2021

Please Visit: https://warrenaverett.com/insights/nonprofit-ratios/

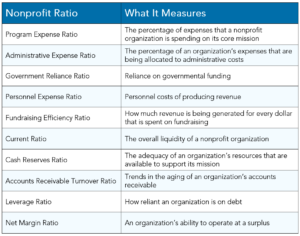

When it comes to the financial management of a nonprofit organization, nonprofit ratios (or key performance indicators) can be a helpful tool to measure how your organization is doing.

There are several ratios that nonprofits may consider including with their regular financial management and reporting.

Below are 10 of the most common nonprofit ratios that are often used both internally for organizations to measure themselves, as well as by external donors and watchdog agencies (such as Charity Navigator) to rate a nonprofit organization’s performance.

(Ed. Note) Is anyone gathering and calculating this type of data

on your university?

1. Program Expense Ratio

The program expense ratio measures the percentage of expenses that a nonprofit organization is spending on its core mission.

This nonprofit ratio is key in the eyes of donors. Charity Navigator generally gives the highest rankings to those organizations whose ratio of program expenses is 85% or higher of their total expenses. Other agencies, such as the Better Business Bureau’s Wise Giving Alliance, recommend a ratio of 65% or higher.

The program expense ratio is calculated as follows:

Program Services Expenses/Total Expenses = Program Expense Ratio

2. Administrative Expense Ratio

The administrative expense ratio measures the percentage of an organization’s expenses that are being allocated to administrative costs.

This nonprofit ratio is often misunderstood. There is an “overheard myth” that organizations shouldn’t spend money on administrative expenses. This is simply unsustainable. In order to stay competitive and to keep up with technology and infrastructure, organizations need to spend money on overhead.

Charity Navigator generally gives its highest rankings to organizations that spend less than 15% of expenses on overhead. The Better Business Bureau’s Wise Giving Alliance recommends a ratio of less than 35%.

The administrative expense ratio is calculated as follows:

Administrative Expenses/Total Expenses = Administrative Expense Ratio

3. Government Reliance Ratio

The government reliance ratio measures a nonprofit organization’s reliance on governmental funding.

This nonprofit ratio is important, particularly when overall levels of government funding are declining. The higher this ratio is, the less likely a nonprofit organization will be able to continue to support its programs in the event that funding goes away. Organizations with high ratios in this category should consider how they can diversify their revenue sources.

The government reliance ratio is calculated as follows:

Government Grants and Contributions/Total Revenue = Government Reliance Ratio

4. Personnel Expense Ratio

The personnel expense ratio simply measures the personnel costs of producing revenue.

The benchmark for this nonprofit ratio may look different for each organization, depending on how service-based the organization is.

For example, an organization that provides counseling services may have a higher ratio than an organization that provides information and advocacy. Organizations should look for trends in this ratio. If it’s costing more to generate the same level of revenue, it could be a sign that there are inefficiencies in operations.

The personnel expense ratio is calculated as follows:

Total Salaries, Wages and Benefits/Total Revenues = Personnel Expense Ratio

5. Fundraising Efficiency Ratio

The fundraising efficiency ratio measures the efficiency of an organization’s fundraising activities. Simply put, it measures how much revenue is being generated for every dollar that is spent on fundraising.

A lower ratio is considered better, and Charity Navigator gives its highest ratings to those organizations that spend less than $.10 for every dollar raised. This equates to a ratio of 10.0 to 1.0, and can be calculated as follows:

Total Contributions/Fundraising Expenses = Fundraising Efficiency Ratio

6. Current Ratio

The current ratio is used to measure the overall liquidity of a nonprofit organization.

In its simplest form, it shows how many dollars of current assets an organization has to cover its current obligations. The higher the ratio, the more liquid the organization.

As a rule of thumb, organizations should strive for a current ratio of 1.0 or higher. An organization with a ratio of 1.0 would have one dollar of assets to pay for every dollar of current liabilities.

The current ratio for nonprofits is calculated as follows:

Current Assets/Current Liabilities = Current Ratio

7. Cash Reserves Ratio

The cash reserves ratio, sometimes referred to as the defensive interval ratio, measures the adequacy of an organization’s resources that are available to support its mission.

This nonprofit ratio looks at how many months of cash are on hand to cover expenses. The recommended range for cash reserves is three to six months.

The cash reserves ratio is calculated as follows:

Unrestricted Cash and Liquid Investments/Average Monthly Expenses (less Depreciation and Other Noncash Expenses) = Cash Reserves

8. Accounts Receivable Turnover Ratio

The accounts receivable turnover ratio is used to show trends in the aging of an organization’s accounts receivable.

The benchmark depends on an organization’s typical payment terms. For example, if an organization’s typical payment terms are net 30 days, then you would expect the accounts receivable turnover to be around 12 times per year (every 30 days).

If the accounts receivable turnover for the same organization was nine times a year (every 40 days), it would be an indicator that the organization was having difficulty collecting its receivables on a timely basis.

The accounts receivable turnover ratio is calculated as follows:

Net Sales/Average Accounts Receivable = Accounts Receivable Turnover

9. Leverage Ratio

The leverage ratio measures how heavily leveraged an organization is. In other words, how reliant is an organization on debt?

A lower score is better here, with the top-rated charities generally having ratios of less than 5% to 10%. Nonprofits should also pay attention to increasing trends with this ratio. An increasing leverage ratio could be a sign of financial trouble for an organization.

The leverage ratio is calculated as follows:

Total Liabilities/Total Assets = Leverage Ratio

10. Net Margin Ratio

The net margin ratio measures an organization’s ability to operate at a surplus. In simple terms, it’s what is left at the end of the day to reinvest into an organization’s mission.

Nonprofits should not be expected to not make a profit. They should, however, be expected to be good stewards of the profit that is generated. In addition, continued negative trends in the net margin ratio can be an indicator of poor financial management.

The net margin ratio is calculated as follows:

Total Revenues less Total Expenses/Total Revenues = Net Margin Ratio

Learn More about Nonprofit Financial Management and Nonprofit Ratios

Nonprofits should keep in mind that every organization is unique. Not every ratio will make sense for every organization. However, nonprofit ratios can be a useful tool to monitor an organization’s performance—especially in identifying trends that may be negatively impacting an organization. https://warrenaverett.com/insights/nonprofit-ratios/

Is anyone gathering and calculating this type of data

on your university?